INSIGHTS

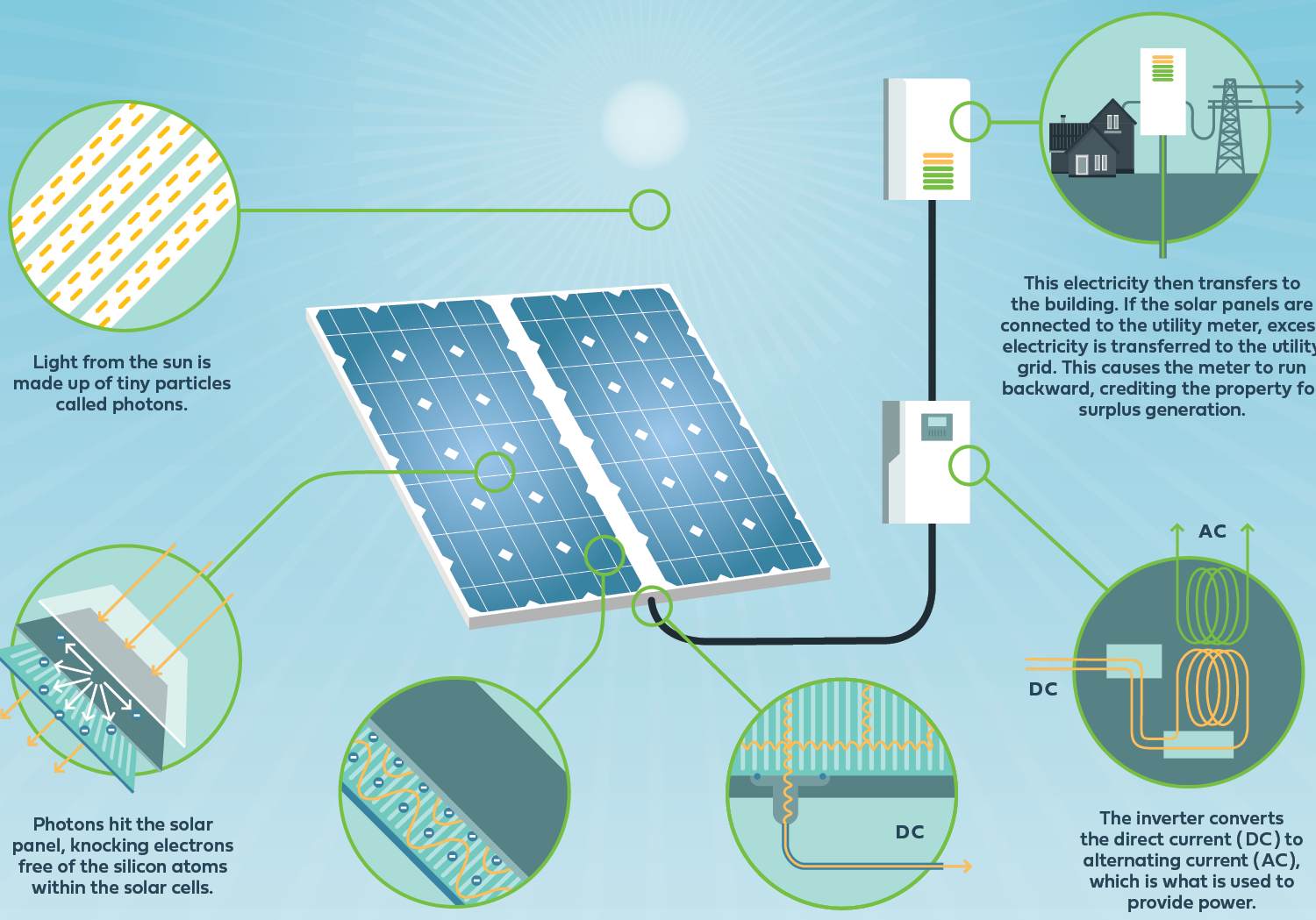

How solar panels harvest solar energy

Greenbacker Co-Head of Business Development shares his thoughts on the renewables landscape and the Inflation Reduction Act

Greenbacker Capital CEO discusses how capital can address the climate crisis and the impact of Greenbacker’s investments

Battery storage can offer stable return streams

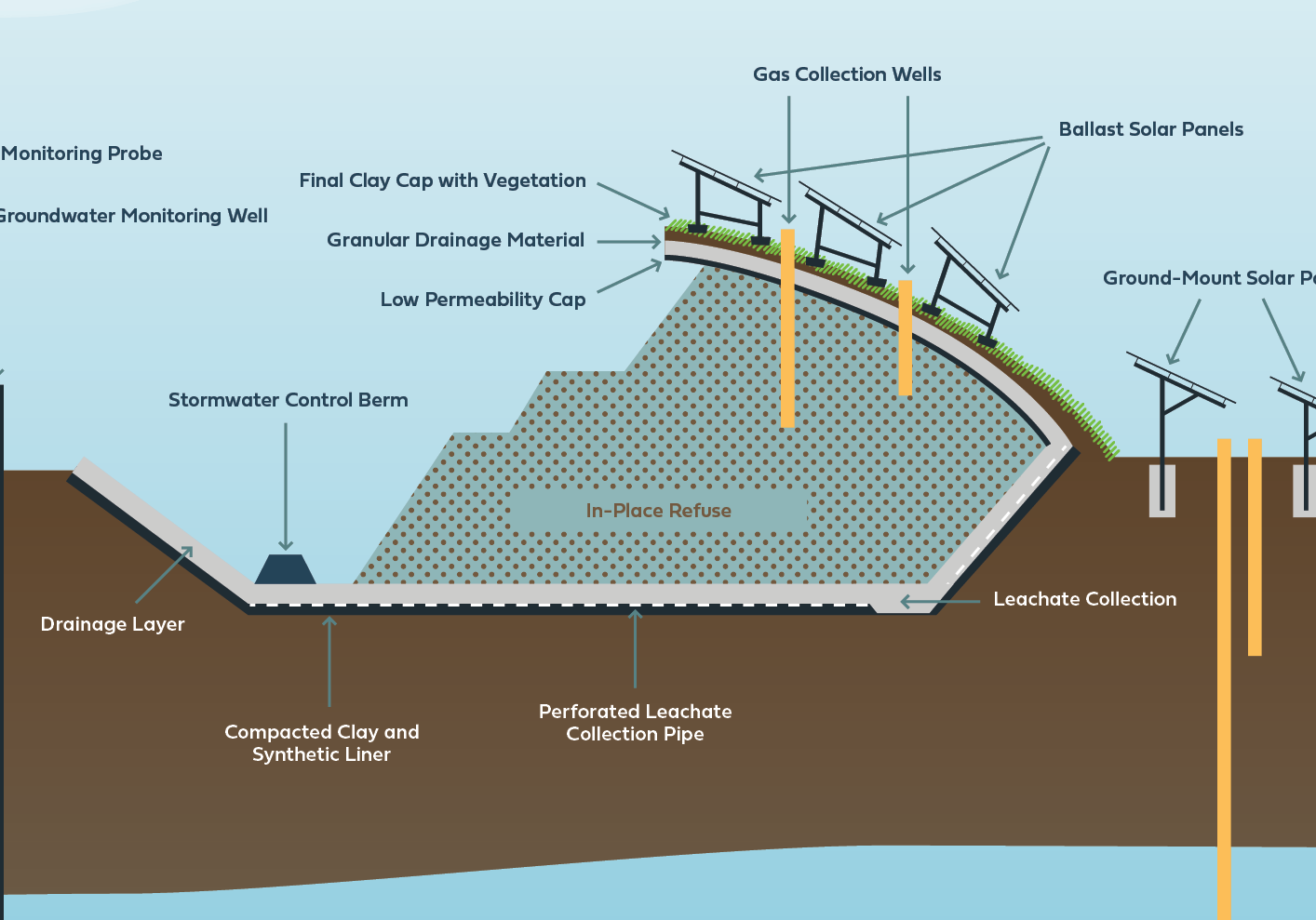

How solar on landfill works

With agrivoltaics, solar sites harvest more than just clean energy

PRESS ROOM

Greenbacker completes $437 million financing for repowers in company milestone: first wind repowers to leverage the domestic content bonus

These repowers mark a significant energy transition milestone for Greenbacker, as they’re among the first clean energy projects to qualify for both the 30% investment tax credit and the 10% domestic content bonus newly established under the Inflation Reduction Act. They also represent Greenbacker’s first projects financed via sale-leaseback, enhancing upfront proceeds and transaction efficiency by capturing the benefits of tax equity financing and back leverage lending in one transaction.

Greenbacker Development Opportunities releases 2023 Impact Report

The Greenbacker Development Opportunities Funds (collectively, “GDEV”), investment vehicles affiliated with Greenbacker Capital Management that make growth capital investments in sustainable infrastructure and renewable energy platforms, have released their 2023 Impact Report. “GDEV is focused on enabling the development of renewable power generation and the transition to a carbon-free electrical grid,” said Benjamin Baker, Managing Director of GDEV. “We’re proud to showcase our steadfast commitment to clear and actionable policies within Greenbacker and across our portfolio companies to work towards a brighter, greener future.”

Greenbacker delivers 2023 results

Greenbacker Renewable Energy Company has announced financial results for 2023, detailing annual revenue and year-over-year growth in operating capacity and clean energy generation, as well as annual highlights that include the company’s first wind asset repowers, its milestone monetization of IRA incentives, and the launch of Greenbacker Capital Management’s fourth sustainability driven investment strategy, focused on Energy Transition Real Estate. “After continuing to accelerate Greenbacker’s growth in 2023, we look forward to pushing the boundaries even further in 2024,” said Greenbacker CEO Charles Wheeler.

Greenbacker grows investments team to continue push into Energy Transition Real Estate, hires new Head of Acquisitions

Greenbacker Capital Management is pleased to announce the expansion of its real estate investments team with the hire of Evan Sherman as Head of Real Estate Acquisitions. Sherman’s addition bolsters the capabilities of GCM’s fourth sustainability-driven investment strategy, which focuses on acquiring undervalued real estate where the company can leverage access to the grid to host distributed generation, storage, and EV charging infrastructure. Sherman rejoins former Blackstone colleague, David Zackowitz, who launched Greenbacker’s sustainable real estate business in 2023.

Lightshift Energy raises $100 million from Greenbacker Capital Management to expand utility scale battery storage across North America

Lightshift Energy, formerly known as Delorean Power, announced capital infusions totaling $100 million from Greenbacker Capital Management LLC (“GCM”). The company has secured $20 million from a GCM-affiliated investment vehicle dedicated to making growth equity investments in sustainable infrastructure development platforms. These funds will be used to scale Lightshift’s team, accelerate sales, and grow its pipeline. In addition, Lightshift has secured $80 million from a second GCM-affiliated investment vehicle that invests in sustainable infrastructure assets. This capital will support the construction and operations of Lightshift’s portfolio.

Greenbacker Capital Management’s largest clean energy asset to date enters commercial operation

Greenbacker Capital Management announced that its largest operating asset to date has entered commercial operation. The 240 MWdc / 200 MWac utility-scale Appaloosa Solar 1 began delivering solar energy on January 24, 2024, helping contribute to Meta’s 100% renewable energy and net zero goals. In addition to representing a company milestone, the financing for the project also marked one of the first tax equity transactions to utilize the solar production tax credit newly expanded by the Inflation Reduction Act.

Greenbacker announces new Chief Financial Officer, expands team with new Head of Infrastructure and Head of Capital Markets

Greenbacker is pleased to announce the appointment of Christopher Smith, CFA as CFO, effective February 1, 2024. Greenbacker also welcomes Daniel De Boer as Head of Infrastructure and Carl Weatherley-White as Head of Capital Markets. These newly created roles, integral to the firm’s growth, underscore Greenbacker’s expanding strategy, capability, and commitment to investing in the energy transition.

Greenbacker secures $92 million financing for storage and solar portfolio

Greenbacker Capital Management has entered into a $92 million financing agreement with BMO. The financing package—which includes a construction to term loan, tax equity bridge loan, term loan commitment, and letter of credit facility—will be used to support construction of the company’s largest standalone battery energy storage system (BESS) project to date, the 30 MW / 120 MWh Holtville BESS, as well as a number of community solar projects.

Revolv secures $25 million in project financing for EV fleets

Revolv, a leading full-service provider of electric commercial fleets, today announced it has raised $25 million in equity project financing to fund the deployment of fleet electrification projects in the United States. Made possible by a commitment from Greenbacker Capital Management through an affiliated investment vehicle focused on sustainable infrastructure, the new Revolv facility will be the first dedicated non-recourse financing facility for commercial EVs and charging stations in North America.

Greenbacker delivers third quarter results

Greenbacker announces third quarter financial and operational results, including year-over-year increases in clean power operating capacity, production, and revenue, as well as valuation adjustments to address interest rates and rising insurance costs. The Company’s operating capacity increased by 305 MW, including its third largest operating project to date–the 99 MW Fall River solar project in South Dakota.