GREC 2025 Annual Meeting of Shareholders

The GREC 2025 Annual Meeting of Shareholders originally scheduled for May 30, 2025 has been adjourned and rescheduled to July 31, 2025 at 1:00pm Eastern, to allow additional time for shareholders to submit their votes. You may vote your shares online, review the proxy material and/or register to attend the Meeting by visiting https://web.viewproxy.com/

Greenbacker Renewable Energy Company (GREC) is a publicly reporting, non-traded limited liability company that acquires and manages income-generating renewable energy and other energy-related businesses. Our business objective is to generate attractive risk-adjusted returns for our investors, consisting of both current income and long-term capital appreciation. We do this by acquiring and financing the construction and operation of income-generating renewable energy and sustainable development projects, primarily within North America. GREC invests in a diversified portfolio of income-producing renewable energy power facilities that sell long-term electricity contracts to off-takers with high credit quality, such as utilities, municipalities, and corporations.

By the numbers

Calendar Year Returns (2)

| Class P-I (3) | 5.52% | 6.60% | 8.84% | 6.89% | 10.07% | 4.10% | 6.71% | 0.15% | -1.88% | -34.97% |

| Class P-A (4,5) | 4.55% | 1.58% | 0.92% | 5.64% | 9.48% | 6.09% | 6.40% | 0.10% | -1.68% | -35.68% |

| Class P-D (6) | - | - | - | - | - | 3.94% | 6.20% | 0.13% | -1.73% | -34.92% |

| Class P-T (6) | - | - | - | - | - | 3.82% | 5.41% | -0.96% | -1.92% | -35.01% |

| Class P-S (6) | - | - | - | - | - | 3.98% | 6.13% | -0.82% | -2.18% | -35.77% |

Past performance is not indicative of future results. Return information is unaudited and subject to change. All returns shown assume reinvestment of distributions and are net of all expenses.

- Monthly Share Value (MSV) based calculations involve significant professional judgment. The calculated value of our assets and liabilities may differ from our actual realizable value or future value, which would affect the MSV as well as any returns derived from MSV, and ultimately the value of your investment. See the Private Placement Memorandum (“PPM”) for additional details related to the calculation of MSV. On February 4, 2025, GREC filed an 8-K with the SEC regarding an update to the Company's net asset value update process, upon which MSV is based. For more information, please view the 8-K filing.

- Returns shown reflect the percentage change in the MSV per share from the beginning of the applicable period, plus the amount of any distribution per share declared in the period. All returns are unaudited, assume the reinvestment of distributions, and are net of all expenses including G&A expenses, management fees, performance participation fees, and share class specific fees, as applicable.

- Class P-I shares launched in May 2016, no returns prior to launch.

- Class P-A shares launched in May 2016, no returns prior to launch.

- Class P-A shares were converted into Class P-I shares during the quarter ended June 30, 2017 and were not offered for sale for the period through April 15, 2018. Effective April 16, 2018, Class P-A shares were again offered.

- Class P-D, P-T, and P-S shares launched in February 2021, no returns prior to launch.

- 2025 YTD figures are representative of the period of January 1, 2025 through June 30, 2025.

Operational growth highlights

(Year-over-year)

AS OF 3/31/25

Operating fleet grew by 3%.

Total power production increased by 12%.

Converting pre-operating projects into assets generating revenue

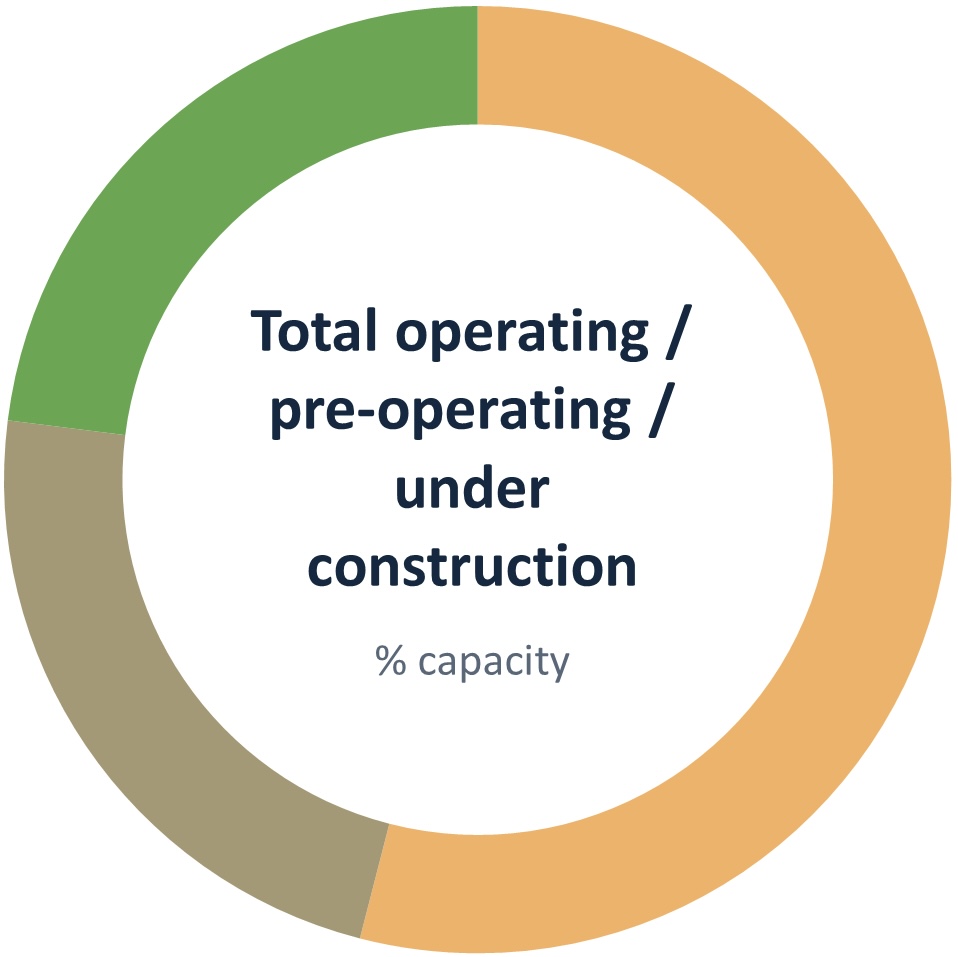

Operating

53%

Pre-operating

24%

Under construction

23%

3.0 GW

total clean power generating and storage capacity

1.6 GW

total operating capacity

23%

of project fleet is in construction, expected to be built by 2027

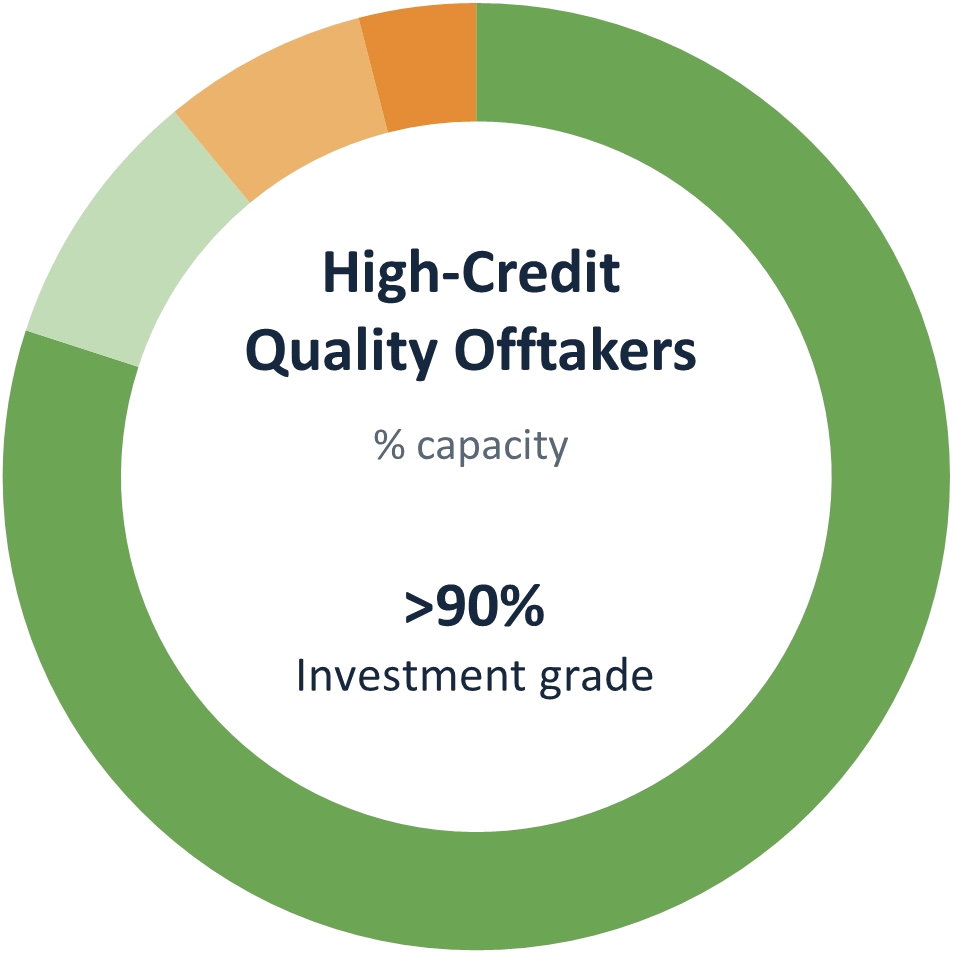

Long-term contracted cash flows1

Investment-grade utility

80%

Investment-grade corporation

9%

Non-rated3

7%

Investment-grade municipality

5%

256

total unique offtakers contracted to purchase power from GREC

<10%

no single offtaker accounts for more than ~10% of our contracted revenue

17.3 years2

average remaining PPA term of total portfolio

Capturing value across strategic areas of the country

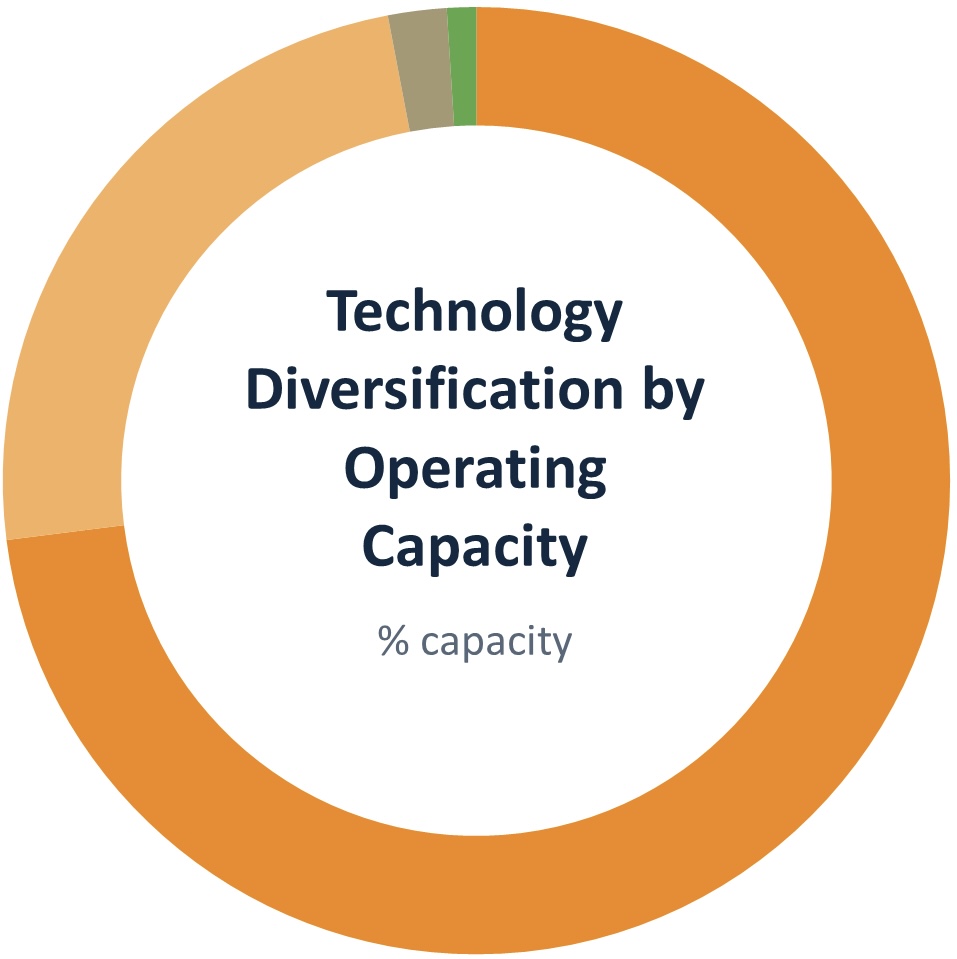

Solar

73%

Wind

24%

Solar + Storage

2%

Battery Storage

1%

400+

renewable energy assets4 representing a total of 3.0 GW

Diversified

across solar, wind, and storage

35 States

provinces, territories, and Washington, D.C.

Diversification does not assure a profit or protect against loss in a declining market. Some figures may not add to stated totals due to rounding.

- References to cash flow reflect project-level cash flows and do not reflect investor-level cash flow or distributions. A portion of the portfolio of less than 1% includes offtakers that are categorized as non-investment grade and are not visually represented in the chart.

- Weighted average remaining contract term refers to the power purchase agreements (“PPA”) of our total assets.

- Non-rated off-takers are unrated by credit rating agencies.

- Prior to 3Q20 the Company did not formally track total asset and capacity statistics for projects the Company had contracted to acquire but had not yet closed.

TEAM

DAN DE BOER

INTERIM CHIEF EXECUTIVE OFFICER

ARMAND DEHANEY

PRINCIPAL, INVESTMENTS

JACQUELINE FEDIDA

VP, INVESTMENTS

BAILEY PLUMMER

PRINCIPAL, INVESTMENTS

CARL WEATHERLEY-WHITE

INTERIM CFO | EXECUTIVE COMMITTEE

GREC Portfolio Activity

Greenbacker acquires pair of operational wind assets in Minnesota totaling 30.7 MW

With these projects—Ridgewind (25.3 MWdc) and WindShare (5.4 MWdc)—Greenbacker continues to expand its presence in the North Star State and diversify its wind portfolio in the Midwest.

Greenbacker Capital names Mehul Mehta as Chief Investment Officer

Greenbacker Capital Management, LLC, a leader in sustainable infrastructure investment, is pleased to announce that Mehul Mehta has been promoted to the position of Chief Investment Officer, effective October 2021. Since joining Greenbacker in June 2016, Mehul has been essential in shaping the firm’s growth trajectory.

Greenbacker acquires Denver airport solar projects totaling 18.4 MWdc

The pair of pre-operational projects join several operational solar assets that Greenbacker owns at Denver International Airport—including two community solar gardens—adding scale to the company’s national solar operations and increasing its already substantial presence in Colorado.

At Altamont Pass in Alameda County, East Bay Community Energy brings 57 MW of local clean energy online

The Scott Haggerty Wind Energy Center is home to 23 new 2.5-MW turbines which will power more than 47,000 homes in East Bay Community Energy’s district each year.

Investor Center

For account-related inquiries, contact our Transfer Agent at (833) 404-4104

For completed Greenbacker paperwork:

Regular Mail

PO Box 219255

Kansas City, MO 64121-9255

Overnight Mail

430 W 7th St Ste 219255

Kansas City, MO 64105-1407