Sustainable Infrastructure

2025 Outlook on Energy Transition Investment

In Greenbacker’s 2025 Outlook Roundtable, available on Asset TV’s website and Bloomberg channel, heads of strategy Ben Baker, Dan De Boer, and David Zackowitz offer their insights on 2025 energy transition opportunities. Trends they see playing out next year include surging energy demand, the rising importance of grid resilience for homes and businesses, and the increasing need for datacenters to access outsized quantities of power.

Greenbacker broadens fundraising capabilities with new senior business development hires

Greenbacker Capital Management has expanded its distribution and fundraising capabilities, particularly in markets where Greenbacker is seeing increasing investor demand for sustainable investments. As senior members of the business development team, Adam Evans, CAIA, CIMA and John Hennessey broaden Greenbacker’s ability to offer individual and institutional investors the opportunity—across all distribution channels—to participate in the energy transition.

kWh Analytics pioneers first-of-its-kind parametric wind proxy hedge for Greenbacker with Munich Re, MUFG

kWh Analytics, the market leader in Climate Insurance, announced the successful close of a groundbreaking wind proxy hedge risk transfer product for a 59MW, 14-turbine wind project in Maine, developed by a Greenbacker Capital Management affiliated investment vehicle that invests in sustainable infrastructure assets. Alberto Mihelcic Bazzana, Director at MUFG, said: “As a leader in project finance, MUFG is pleased to partner with Greenbacker, kWh Analytics, and Munich Re in developing new financing solutions that can expedite the energy transition process.”

Lightshift Energy raises $100 million from Greenbacker Capital Management to expand utility scale battery storage across North America

Lightshift Energy, formerly known as Delorean Power, announced capital infusions totaling $100 million from Greenbacker Capital Management LLC (“GCM”). The company has secured $20 million from a GCM-affiliated investment vehicle dedicated to making growth equity investments in sustainable infrastructure development platforms. These funds will be used to scale Lightshift’s team, accelerate sales, and grow its pipeline. In addition, Lightshift has secured $80 million from a second GCM-affiliated investment vehicle that invests in sustainable infrastructure assets. This capital will support the construction and operations of Lightshift’s portfolio.

Growth Capital

GDEV releases 2024 Energy and Impact Report

As part of GDEV Management, LLC’s (GDEV) commitment to support sustainable infrastructure and energy technologies, GDEV today released its 2024 Energy and Impact Report. GDEV’s investments scale energy businesses and advance critical infrastructure. With more than $400 million deployed in over a dozen platform investments, GDEV continues to bridge the gap between capital markets and real asset development. Among the report’s notable takeaways, GDEV’s portfolio, includes 12 active sustainable infrastructure platforms and 421 full time employees, generated 652 GWh of clean energy across 45 U.S. states and 3 Canadian provinces.

2025 Outlook on Energy Transition Investment

In Greenbacker’s 2025 Outlook Roundtable, available on Asset TV’s website and Bloomberg channel, heads of strategy Ben Baker, Dan De Boer, and David Zackowitz offer their insights on 2025 energy transition opportunities. Trends they see playing out next year include surging energy demand, the rising importance of grid resilience for homes and businesses, and the increasing need for datacenters to access outsized quantities of power.

Greenbacker broadens fundraising capabilities with new senior business development hires

Greenbacker Capital Management has expanded its distribution and fundraising capabilities, particularly in markets where Greenbacker is seeing increasing investor demand for sustainable investments. As senior members of the business development team, Adam Evans, CAIA, CIMA and John Hennessey broaden Greenbacker’s ability to offer individual and institutional investors the opportunity—across all distribution channels—to participate in the energy transition.

3V Infrastructure launches to expand access to EV charging and accelerate widespread adoption of electric vehicles

3V Infrastructure, a new electric vehicle charging infrastructure owner and operator, announced its formation today and has secured a commitment of up to $40 million from an affiliate of Greenbacker Capital Management that provides strategic growth capital to leading energy transition companies. “Greenbacker is thrilled to partner with the founders of 3V to tackle the Level 2 charging space,” said Quinn Pasloske, Principal at Greenbacker. “Working with real estate owners to deliver accessible, affordable charging to their tenants presents an extremely attractive risk-adjusted return. 3V brings an infrastructure mindset to an emerging market and, as an early mover, aims to capitalize on the long-term fundamental value of the sector.”

Sustainable Real Estate

2025 Outlook on Energy Transition Investment

In Greenbacker’s 2025 Outlook Roundtable, available on Asset TV’s website and Bloomberg channel, heads of strategy Ben Baker, Dan De Boer, and David Zackowitz offer their insights on 2025 energy transition opportunities. Trends they see playing out next year include surging energy demand, the rising importance of grid resilience for homes and businesses, and the increasing need for datacenters to access outsized quantities of power.

Greenbacker broadens fundraising capabilities with new senior business development hires

Greenbacker Capital Management has expanded its distribution and fundraising capabilities, particularly in markets where Greenbacker is seeing increasing investor demand for sustainable investments. As senior members of the business development team, Adam Evans, CAIA, CIMA and John Hennessey broaden Greenbacker’s ability to offer individual and institutional investors the opportunity—across all distribution channels—to participate in the energy transition.

Greenbacker grows investments team to continue push into Energy Transition Real Estate, hires new Head of Acquisitions

Greenbacker Capital Management is pleased to announce the expansion of its real estate investments team with the hire of Evan Sherman as Head of Real Estate Acquisitions. Sherman’s addition bolsters the capabilities of GCM’s fourth sustainability-driven investment strategy, which focuses on acquiring undervalued real estate where the company can leverage access to the grid to host distributed generation, storage, and EV charging infrastructure. Sherman rejoins former Blackstone colleague, David Zackowitz, who launched Greenbacker’s sustainable real estate business in 2023.

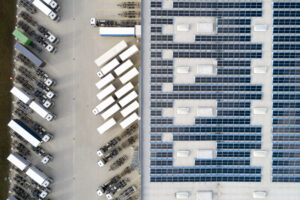

The power play: Distributed energy resources

Today there is an unparalleled opportunity to create value by hosting and monetizing multiple onsite distributed energy resources (DERs). Proximity to strategic grid interconnection is key to facilitating the storage and sale of power, which can provide benefits like additional revenue, energy resilience, and rental appeal for both property owners and tenants.