The energy transition’s momentum has been galvanized by record-breaking investments and deployment, decreasing costs, policy incentives, and innovation.1

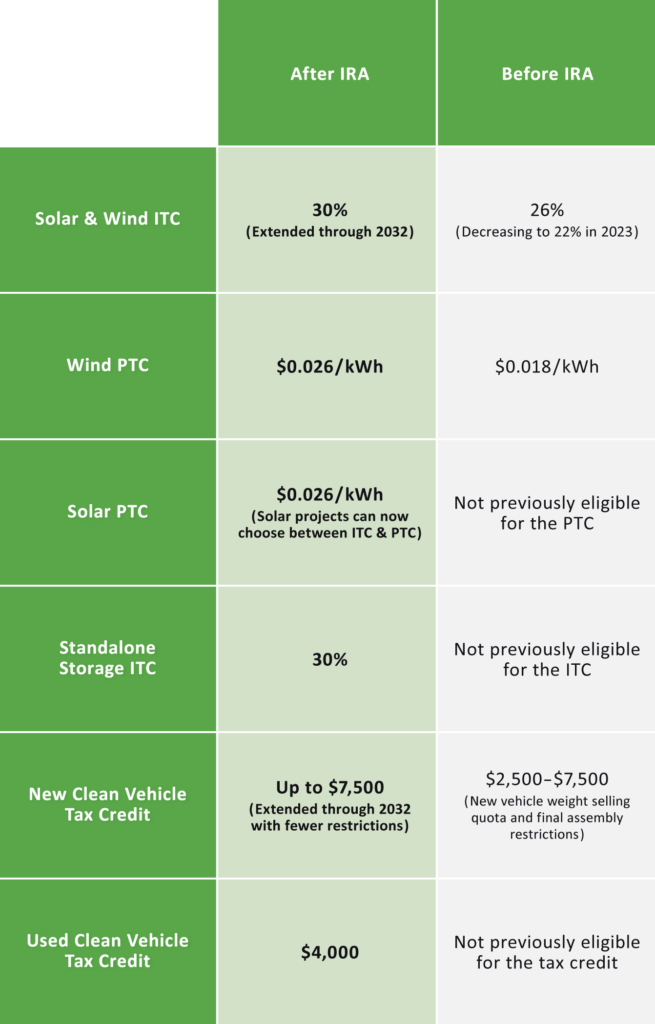

A major headline is the impact that the Inflation Reduction Act (IRA) has had on the US power sector. The legislation provided an estimated $370 billion to promote clean energy investments and energy security, and renewable energy companies have begun utilizing the new tax incentives it created.

In its annual World Energy Outlook 2023 report, the International Energy Agency (IEA) highlighted this year’s solar and EV growth surge, among many other clean energy growth trends within the energy transition. The report also describes the challenges ahead and offers guidance on the investments needed to achieve Net Zero Emissions (NZE) by 2050.

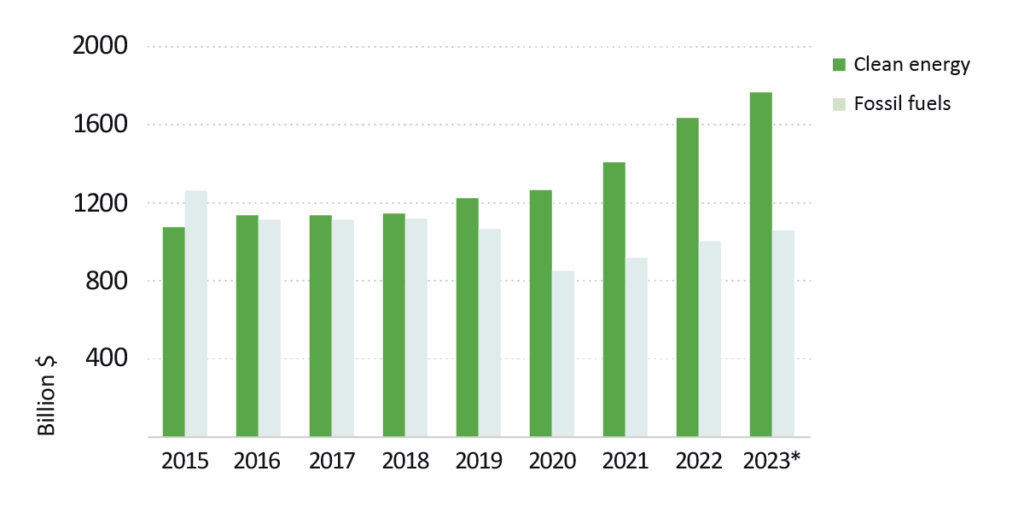

Clean energy investment continues to significantly outpace fossil fuels

Five years ago, spending on clean energy and fossil fuels was neck and neck. Today, for every dollar spent on fossil fuels, 1.8 dollars are spent on clean energy.

Since 2020, global investment in clean energy is up 40%, the report finds, driven not only by the need to reduce carbon emissions, but also by the favorable economics of mature clean energy technologies. The desire to improve energy security (particularly among energy importers), increase supply chain resilience, and create clean energy jobs also contributed to the increased investment.

While some governmental efforts to address some of these issues have also entailed expanding fossil fuel usage, the IEA states, clean energy initiatives are much more the focus. The report cites as examples the IRA in the US, the European Union’s Green Industrial Plan, and increasingly strong support in China, India, Brazil, and elsewhere.

Fossil fuels’ market share is declining; solar energy’s is increasing

And while clean energy investment has grown, fossil fuel investment is roughly where it was five years ago, as can be seen in Table 1, below. The report also indicates that fossil fuel technologies have been losing market share to clean energy technologies, and in some cases may have already peaked, and additionally projects that global consumption across all fossil fuels will peak by the end of the 2020s.

Of the over $1.7 trillion expected to be invested in clean energy by the end of 2023, solar investment continues to lead the way, with over $1 billion a day moving into PV investments, for an annual total of approximately $380 billion. In the US, BloombergNEF underscores this trend, reporting a record high $26 billion invested in solar during the first half of 2023—a 75% increase from the same period in 2022.2

Table 1: Clean energy investment continues to reach record highs

Although investment in fossil fuels has been increasing after several falloffs over the last decade, it is significantly outpaced by the increase in clean energy investment inflows.

Record EV investment and sales

Solar isn’t the only area of the energy transition where the IEA highlights substantial growth. Investment in EVs has more than doubled in the last two years, supported by government incentives around the globe, and is set to reach $130 billion globally in 2023, as consumers continue to buy electric cars in record numbers.

In 2020, one in 25 cars sold globally was electric. In 2023, it’s one in five. IEA data on global sales found that 2.3 million electric cars were sold in the first quarter, a 25% jump from last year.3 The outlook looks even stronger through the end of 2023, with annual sales climbing to 14 million—a 35% increase from 2022’s previous record-setting annual total.

In the US, that growth rate has been even more pronounced. The IEA reports that in 2022 electric car sales increased 55% year-over-year, expanding to an 8% market share. By 2030, the organization projects that market share could increase to 50% by 2030, spurred by the IRA and the Infrastructure Investment and Jobs Act, as well as California’s Advanced Clean Cars II rule and its adoption by other states. The EPA’s proposed emissions standards, if put into practice, could increase that share even further.4 The clean energy incentives and emissions reduction mandates created by these pieces of legislation and policies under the current US administration make it clear that the energy transition is a top priority for the world’s largest economy today.

The Inflation Reduction Act — a boon for clean energy investment and manufacturing

The passage of the IRA created a broad set of historic US tax incentives to support clean energy investment, improve energy security, and increase domestic manufacturing in the clean energy sector. And so far, the results have been encouraging, even though there’s still a ways to go to achieve NZE.

Table 2: Clean energy tax incentives were extended and expanded by the IRA

The IRA’s goal to increase domestic manufacturing has already yielded results. In the US, approximately $150 billion of investments have been announced for manufacturing across a number of clean energy technologies, which the IEA’s report projects will increase annual domestic manufacturing across a number of sectors through the end of the decade, including:

- Battery energy storage production is expected to see a 12-fold increase, reaching 1.2 terawatt-hours by 2030.

- Solar module production is expected to increase nearly 670%, to 40 GW.

- Offshore wind turbine nacelles manufacturing reaches 1.5 GW.

- Hydrogen production is expected to top 5.5 million tonnes.

While these investments will potentially allow the US to meet its stated goals for battery storage, EV, and hydrogen deployment this decade, significantly greater investment in domestic manufacturing capacity is still needed for the country to meet its wind and solar objectives.

The path to 1.5 °C is narrow, but remains open

The IEA projects an additional 500 GW of renewable energy generation capacity will come online in 2023—the largest total annual increase in history.

However, greater investment in clean energy across the board is essential to reach NZE by 2050, limit global warming to 1.5 degrees Celsius above pre-industrial levels, and thus mitigate the most devastating effects of the climate crisis. The IEA’s analysis makes compelling arguments for where investments need to increase to meet that goal:

“Tripling renewable energy capacity, doubling the pace of energy efficiency improvements to 4% per year, ramping up electrification and slashing methane emissions from fossil fuel operations together provide more than 80% of the emissions reductions needed by 2030 to put the energy sector on a pathway to limit warming to 1.5 °C.”5

The analysis from the IEA underscores the huge opportunity for investors who want to put their capital to work in the energy transition—and capitalize on a once-in-a-generation tailwind for the sustainable infrastructure asset class.

Greenbacker Renewable Energy Company is an independent power producer and a leading climate-focused investment manager. Its Greenbacker Capital Management business segment serves as the investment manager to four energy transition focused funds.

1 Unless otherwise noted, all datapoints sourced from the International Energy Agency’s World Energy Outlook 2023 report, published October 24, 2023.

2 Renewable Energy Investment Hits Record-Breaking $358 Billion in 1H 2023, BloombergNEF, Meredith Annex, August 21, 2023.

3 Global EV Outlook 2023 – Executive Summary, International Energy Agency, April 2023.

4 Global EV Outlook 2023 – Executive Summary.

5 World Energy Outlook 2023 – Executive Summary, IEA, October 2023.