GREC 2024 Annual Meeting of Shareholders

The GREC 2024 Annual Meeting of Shareholders, originally scheduled for May 30, 2024 was rescheduled to July 30, 2024 at 9:00am Eastern Time, because quorum was not reached. You may register to attend the Meeting by clicking the “Vote Now!” button and entering your control number provided on the voting materials you received. If you cannot attend the meeting, we ask that you still place your vote by using the “Vote Now!” button on this page.

On April 29th, 2024, our existing investor portal was retired and replaced with a new, modernized portal to improve your online experience and upgrade user security. Existing login credentials remained the same, but you will be asked to supply your Greenbacker account number upon initial login. You will find this information on any previous quarterly statement. Please contact our Service Center at 833-404-4104 for assistance.

Greenbacker Renewable Energy Company (GREC) is a publicly reporting, non-traded limited liability company that acquires and manages income-generating renewable energy and other energy-related businesses. Our business objective is to generate attractive risk-adjusted returns for our investors, consisting of both current income and long-term capital appreciation. We do this by acquiring and financing the construction and operation of income-generating renewable energy and sustainable development projects, primarily within North America. GREC invests in a diversified portfolio of income-producing renewable energy power facilities that sell long-term electricity contracts to off-takers with high credit quality, such as utilities, municipalities, and corporations.

PERFORMANCE OVERVIEW

Past performance is not indicative of future results. Return information is unaudited and subject to change. All returns shown assume reinvestment of distributions and are net of all expenses.

1 As of June 30, 2024. Inception to date (“ITD”) returns are annualized consistent with the IPA Practice Guideline 2018.

2 As of July 1, 2024. There is no assurance GREC will pay distributions in any particular amount, if at all. Any distributions will be at the discretion of the board of directors. GREC may fund distributions entirely from sources other than cash flow from operations, including, without limitation, the sale of assets, borrowings, or offering proceeds. In no event, however, shall funds be advanced or borrowed for the purpose of distributions if the amount of such distributions would exceed the accrued and received revenues for the previous four quarters, less paid and accrued operating costs with respect to such revenues, and costs shall be made in accordance with generally accepted accounting principles, consistently applied. For the quarter ending March 31, 2024, 100% of distributions were funded from a return of principal, cash on hand and other financing sources. By funding distributions with a return of principal to investors, GREC will have less money to invest, which may lower its overall return. For a historical breakdown of the distribution funding sources, please see GREC’s SEC filings. On April 26, 2024, the Board of Directors of GREC approved the reduction to $0 of the daily distribution rates for each of the Class A, C, I, P-A, P-I, P-D, P-T and P-S shares for the period from May 1, 2024 to December 31, 2024, or until such time as the Board affirmatively authorizes a change to these distribution rates.

3 Monthly share value as of July 1, 2024. Monthly Share Value (MSV) based calculations involve significant professional judgment. The calculated value of our assets and liabilities may differ from our actual realizable value or future value, which would affect the MSV as well as any returns derived from MSV, and ultimately the value of your investment. See the Private Placement Memorandum (“PPM”) for additional details related to the calculation of MSV.

4 Returns shown reflect the percentage change in the MSV per share from the beginning of the applicable period, plus the amount of any distribution per share declared in the period. All returns are unaudited, assume the reinvestment of distributions, and are net of all expenses including G&A expenses, management fees, performance participation fees, and share class specific fees, as applicable.

PORTFOLIO STATISTICS

AS OF 3/31/24

3.3 GW

RATED SYSTEM CAPACITY¹

427

NUMBER OF ASSETS¹

35

STATES, PROVINCES, TERRITORIES, AND DISTRICTS

17.8 YEARS

WEIGHTED AVERAGE REMAINING TERM LENGTH²

263

OFFTAKERS WITH POWER PURCHASE AGREEMENTS (PPA)

93.2%

INVESTMENT-GRADE OFFTAKERS

Operational Growth Highlights

(Year Over Year)

AS OF 3/31/24

Fleet operating capacity increased by over 15%

Fleet generated 644,220 MWh of clean power, representing a year-over-year increase of 12%

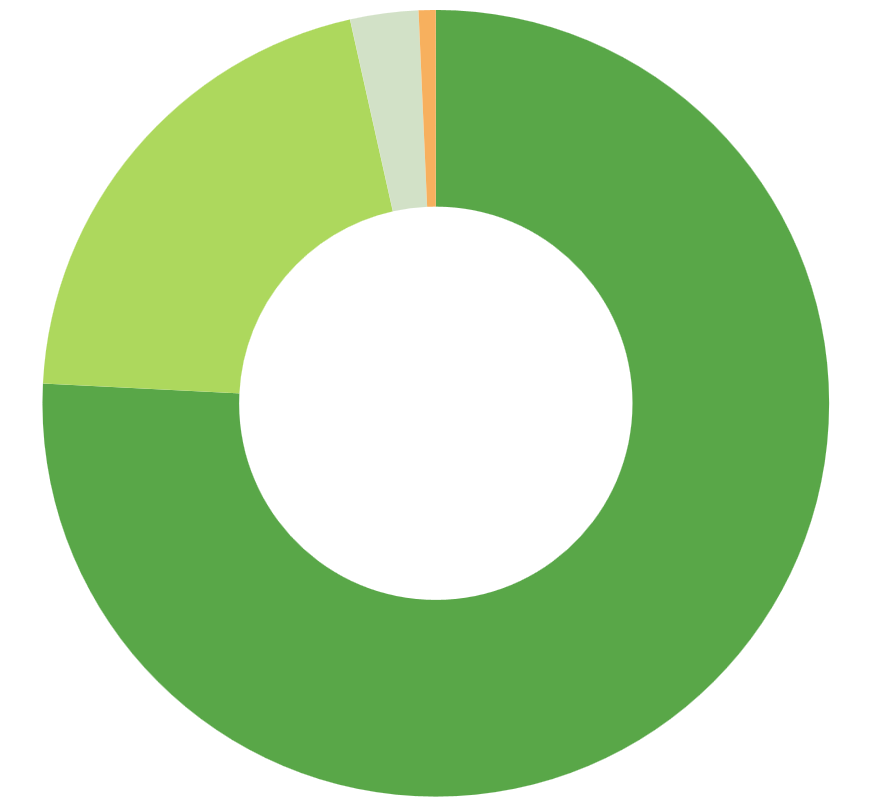

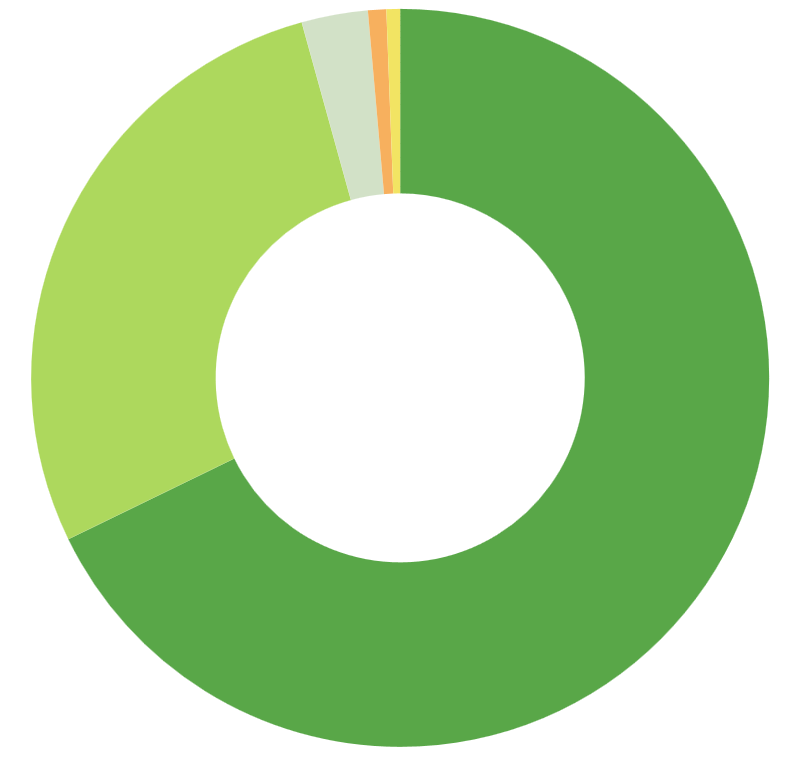

Total Pre-Operating Capacity

(% Capacity)

Total Operating Capacity

(% Capacity)

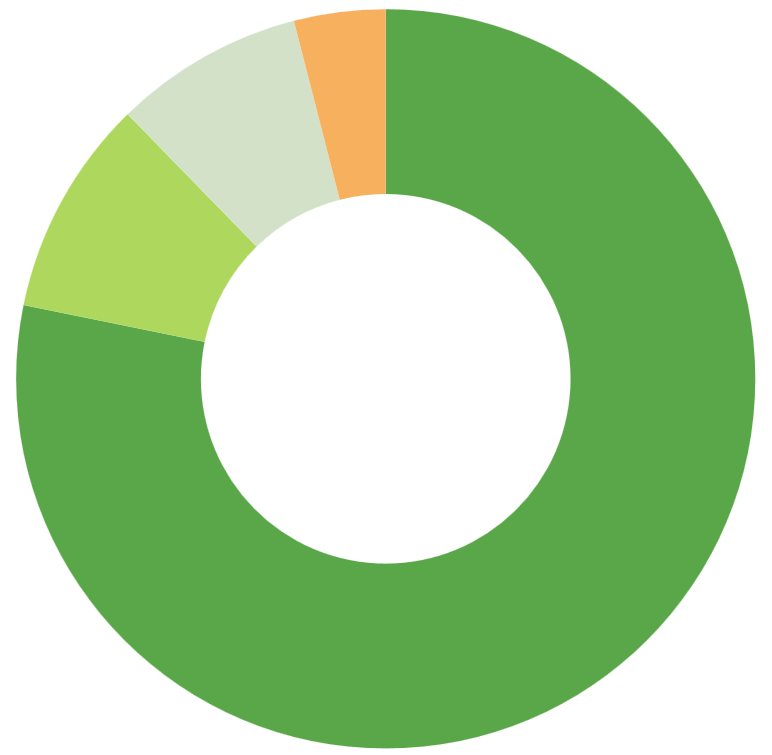

High-Credit-Quality Offtakers

(% Capacity)

Portfolio metrics are unaudited and subject to change.

1 Prior to 3Q20 the Company did not formally track total asset and capacity statistics for projects the Company had contracted to acquire but had not yet closed.

2 Weighted average remaining contract term refers to the power purchase agreements (“PPA”) of our total assets.

3 Non-rated off-takers are unrated by credit rating agencies.

TEAM

ELLE BRUNSDALE

VP, INVESTMENTS

DAN DE BOER

HEAD OF INFRASTRUCTURE, MANAGING DIRECTOR

ARMAND DEHANEY

PRINCIPAL, INVESTMENTS

MIKE DUDUM

VP, INVESTMENTS

JACQUELINE FEDIDA

VP, INVESTMENTS

DONAL MAHONEY

VP, INVESTMENTS

SPENCER MASH

EXECUTIVE VICE PRESIDENT

BAILEY PLUMMER

PRINCIPAL, INVESTMENTS

CHRIS SMITH

CHIEF FINANCIAL OFFICER

BEN TILLAR

PRINCIPAL, INVESTMENTS

CARL WEATHERLEY-WHITE

HEAD OF CAPITAL MARKETS

CHARLES WHEELER

CEO | EXECUTIVE COMMITTEE

MANDY YANG

AVP, INVESTMENTS

GREC Portfolio Activity

Greenbacker acquires pair of operational wind assets in Minnesota totaling 30.7 MW

With these projects—Ridgewind (25.3 MWdc) and WindShare (5.4 MWdc)—Greenbacker continues to expand its presence in the North Star State and diversify its wind portfolio in the Midwest.

Greenbacker Capital names Mehul Mehta as Chief Investment Officer

Greenbacker Capital Management, LLC, a leader in sustainable infrastructure investment, is pleased to announce that Mehul Mehta has been promoted to the position of Chief Investment Officer, effective October 2021. Since joining Greenbacker in June 2016, Mehul has been essential in shaping the firm’s growth trajectory.

Greenbacker acquires Denver airport solar projects totaling 18.4 MWdc

The pair of pre-operational projects join several operational solar assets that Greenbacker owns at Denver International Airport—including two community solar gardens—adding scale to the company’s national solar operations and increasing its already substantial presence in Colorado.

At Altamont Pass in Alameda County, East Bay Community Energy brings 57 MW of local clean energy online

The Scott Haggerty Wind Energy Center is home to 23 new 2.5-MW turbines which will power more than 47,000 homes in East Bay Community Energy’s district each year.

Investor Center

For account-related inquiries, contact our Transfer Agent at (833) 404-4104

For completed Greenbacker paperwork:

Regular Mail

PO Box 219255

Kansas City, MO 64121-9255

Overnight Mail

430 W 7th St Ste 219255

Kansas City, MO 64105-1407