Approximately $38 trillion of investment in the "electrification of everything" will be required to meet global decarbonization goals.¹ We believe that Energy Transition Real Estate with access to grid infrastructure is fundamentally undervalued and mission critical to meeting the growing need for electrification.

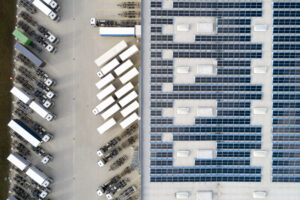

Greenbacker's real estate strategy seeks to acquire, electrify, and lease logistics and industrial outdoor storage (IOS) assets that can benefit from this megatrend by hosting solar, battery energy storage, and EV fleet charging infrastructure. The strategy will leverage the firm's power expertise, deep industry relationships, and 360-degree view of the sustainability landscape to source proprietary deal flow, assist with technical due diligence, and create lasting value for our tenants and our investors.

We will be sharing updates and providing more information as we facilitate the energy transition through real estate investment.

¹Bridging the Vast Gap in Net Zero Capital, Boston Consulting Group, November 30, 2023.

TEAM

EVAN SHERMAN

SVP, HEAD OF ACQUISITIONS

MANDY YANG

AVP, INVESTMENTS

DAVID ZACKOWITZ

HEAD OF REAL ESTATE INVESTMENTS

Careers

Greenbacker has hired a senior executive with over 20 years and $25 billion of commercial real estate principal investment experience to manage this new vehicle and grow the firm’s real estate investment team.

REAL ESTATE press room

Greenbacker grows investments team to continue push into Energy Transition Real Estate, hires new Head of Acquisitions

Greenbacker Capital Management is pleased to announce the expansion of its real estate investments team with the hire of Evan Sherman as Head of Real Estate Acquisitions. Sherman’s addition bolsters the capabilities of GCM’s fourth sustainability-driven investment strategy, which focuses on acquiring undervalued real estate where the company can leverage access to the grid to host distributed generation, storage, and EV charging infrastructure. Sherman rejoins former Blackstone colleague, David Zackowitz, who launched Greenbacker’s sustainable real estate business in 2023.

Greenbacker hires new Head of Real Estate Investments

Greenbacker Capital Management is pleased to announce that David Zackowitz has been hired as the firm’s new Head of Real Estate Investments. He will lead GCM’s fourth sustainability driven investment strategy, focused on acquiring commercial and residential property where the company can reduce emissions and energy use intensity, as well as add additional sources of renewable power.