Company announces annual revenue; year-over-year increases in power generation and operating capacity; and 2023 highlights, including its first wind asset repowers, milestone monetization of IRA incentives, and new energy transition real estate strategy

Key Takeaways

- Greenbacker completed its first project repowers and qualified them for a 40% tax credit, including the IRA’s new domestic content tax credit adder; monetizing this credit via sale-leaseback financing allowed the Company to finance the entire repower cost.

- Company’s operating fleet added 292 MW in 2023, a year-over-year increase of 24% that included bringing online its second and third largest operating assets to date.

- As IRA tailwinds for the energy transition asset class became clearer, Greenbacker was among the first to capitalize on both the domestic content bonus and the new solar production tax credit.

- Greenbacker launched a new strategy focused on Energy Transition Real Estate via the Company’s investment management segment, Greenbacker Capital Management (“GCM”).

- Company’s annual total operating revenue topped $181 million, driven by 38% year-over-year increase in solar power generation; overall production growth was muted due to the three wind assets strategically taken offline for repowers to extend projects’ useful life and potential long-term revenue.

- Over $263 million was raised by GCM’s distribution business for its managed funds, increasing fee-earning AUM to approximately $700 million and boosting Company’s aggregate AUM to $3.8 billion.

- Greenbacker continued to deliver on impact metrics, including carbon abatement, water conservation, and green jobs.

NEW YORK, NY, April 4, 2024 — Greenbacker Renewable Energy Company LLC (“Greenbacker,” “GREC,” or the “Company”), an independent power producer and a leading climate-focused investment manager, has announced financial results1 for 2023, including annual revenue and year-over-year growth in operating capacity and clean energy generation. During the year, the Company’s investment management business segment, Greenbacker Capital Management (“GCM”) also announced the launch of its fourth sustainability driven investment strategy, focused on Energy Transition Real Estate.

Company completed first project “repowers;” monetized domestic content bonus with sale-leaseback financing; and increased operating fleet by 24%

GREC’s fleet of renewable power projects continued to grow and diversify in 2023, as the Company captured opportunities created by the newly minted Inflation Reduction Act (“IRA”).

On the independent power producer (“IPP”) side of its business, Greenbacker—working closely with its contractor Bedrock Renewables (“Bedrock”)—completed its first wind repowers (replacing older wind turbines on existing GREC assets with new, more efficient ones), bringing three projects through redevelopment and construction. Two of these projects entered commercial operation in late 2023, with the third reaching that milestone in February 2024.

Repowering these facilities creates value for Greenbacker in several ways, including:

- Harnessing efficiency gains in newer technologies to improve the projects’ power-generating ability.

- Extending the projects’ expected useful life and contracted power purchase agreements (“PPAs”).

- Requalifying the projects for additional tax credits under the IRA.

- Reducing ongoing maintenance costs by completely replacing aging equipment with new equipment.

As part of Greenbacker’s repower strategy, the Company and Bedrock sourced equipment for the projects domestically, supporting well-paying long-term jobs for Americans and qualifying the facilities for the domestic content tax credit adder. The domestic content requirements of the IRA offer a 10% bonus investment tax credit (“ITC”), bringing the total credit to 40% of the qualified build cost. Monetizing this credit through a sale-leaseback financing allowed Greenbacker to fully finance the repower cost.

As IRA tailwinds for the energy transition asset class became clearer, Greenbacker was among the first to capitalize on two of its new incentives

While the IRA was passed into law in 2022, the benefits of the legislation were difficult to realize in 2023. Delays in IRS guidance for how the credits would be interpreted2 limited transactional volume throughout the year. As guidance was issued month by month, the market began to form a transactional precedent, and volumes increased. Greenbacker was at the forefront of these structural developments.

In addition to GREC transacting on one of the first domestic content tax credit transactions, a GCM-affiliated investment vehicle also completed one of the industry’s first solar PTC deals3—a $148 million tax equity commitment to finance what is now the largest operating clean energy asset to date across the combined GREC and GCM project fleet. In 2024, Greenbacker expects the tax equity financing market to stabilize even further as precedent becomes more established and transactional efficiencies increase.

Greenbacker launches new strategy focused on Energy Transition Real Estate; Company’s aggregate AUM increased to $3.8 billion

Greenbacker’s investment management business segment GCM also reached another new milestone in the year, launching its fourth sustainability driven investment strategy. GCM hired former Blackstone Managing Director David Zackowitz to the newly created position Head of Real Estate Investments to lead the strategy, as well as expand its real estate investment team with other key hires, including former Blackstone Principal Evan Sherman. The new strategy focuses on acquiring Energy Transition Real Estate where the company can leverage access to electricity to host distributed generation, storage, and charging infrastructure.

GCM raised over $263 million for its managed funds during the year, increasing fee-earning AUM4 to approximately $700 million, as of December 31, 2023. Aggregate AUM,5 which includes the assets managed for Greenbacker Renewable Energy Company, for which GCM does not receive management fees, rose to approximately $3.8 billion. As of December 31, 2023, GCM served as the investment manager to five energy transition-focused funds.

Company’s annual total operating revenue topped $181 million, driven by 38% year-over-year increase in solar power generation; total annual production increases were muted, due to wind assets strategically taken offline for repowering

GREC’s fleet of clean energy projects produced approximately 2.5 million megawatt-hours (“MWh”) of total power, representing a year-over-year increase of 7%. That increase was primarily due to a 38% annual production increase from Greenbacker’s operating solar fleet, which generated nearly 1.5 million MWh of clean power. The new solar assets brought online during 2023 helped drive this production growth and contributed an additional $11.4 million to the fleet’s annual operating revenue. In 2024, these new assets are expected to generate $21.8 million in operating revenue.

The fleet’s production growth was somewhat constrained by the three wind assets that Greenbacker strategically took offline to repower with new equipment. Despite being out of operation for portions of the year while that work was conducted, the three projects generated $14.6 million in annual operating revenue in 2023. With their repowering complete, those projects have now returned to operation, are generating wind energy at higher efficiency, and are expected to contribute $24.2 million to the fleet’s operating revenue in 2024.

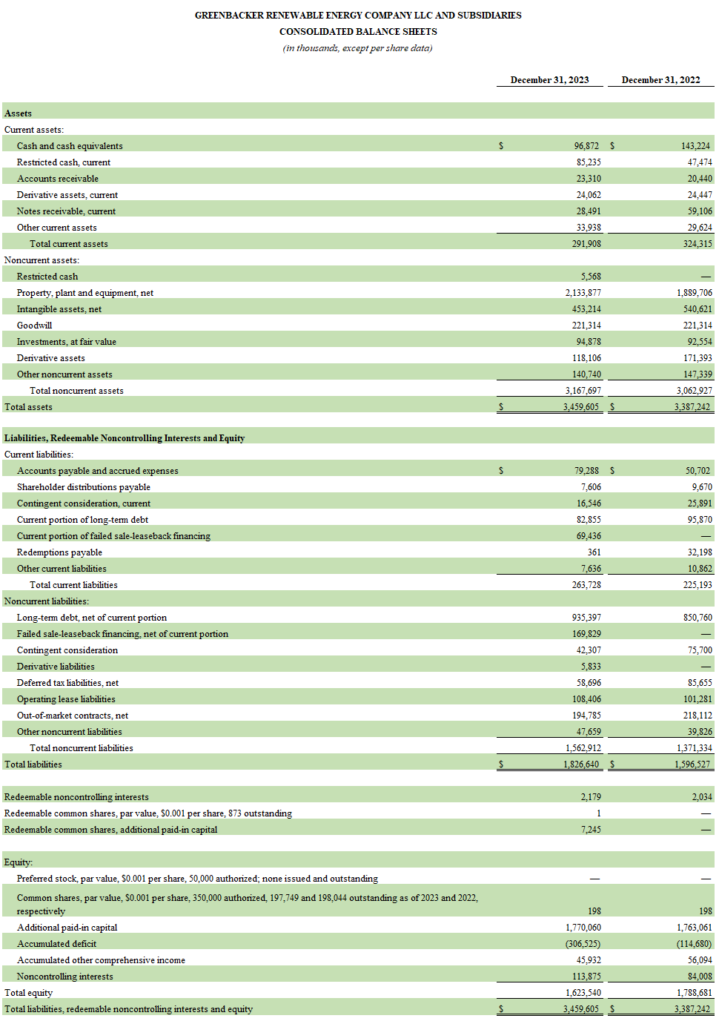

| GREC Operating Fleet | 2023 | 2022 | YoY Increase (total) | YoY increase (%) |

| Clean power produced by solar assets (MWh) | 1,473,384 | 1,067,114 | 406,750 | 38% |

| Clean power produced by wind assets (MWh) | 978,236 | 1,198,236 | (220,000) | (18)% |

| Total clean power generated* (MWh) | 2,452,100 | 2,265,350 | 186,750 | 8% |

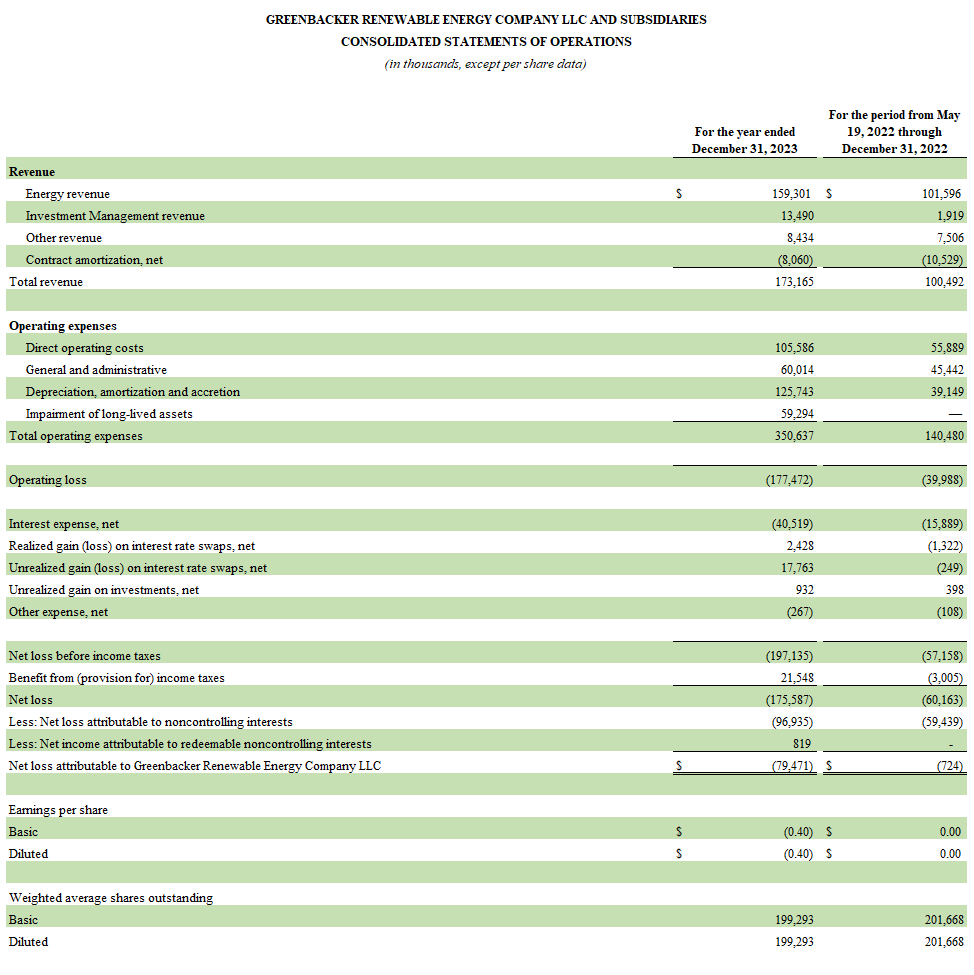

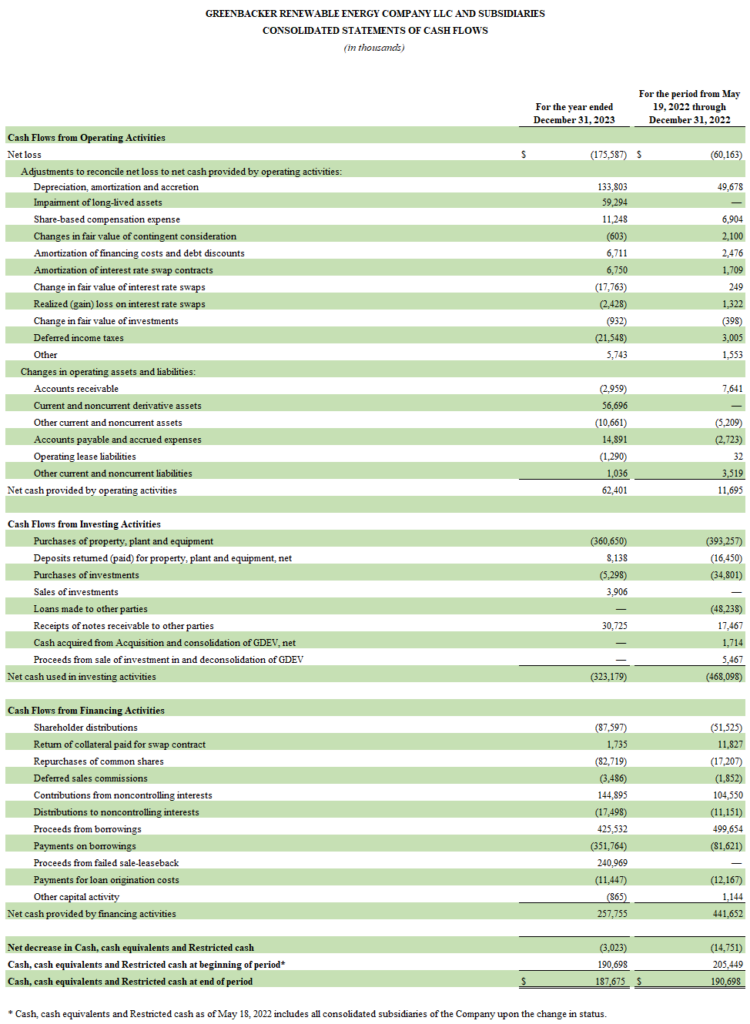

During 2023, Greenbacker generated total operating revenue of $181.2 million, primarily driven by energy revenue within the IPP segment, which totaled $159.3 million and included $134.6 million from the Company’s long-term PPAs. Funds From Operations (“FFO”) was $(11.5) million for the period and represents the $31.8 million of Adjusted EBITDA less cash interest expense and distributions to our tax equity investors. The net loss attributable to Greenbacker was approximately $79.5 million, driven by non-cash depreciation, amortization, and impairment charges recorded during the period.

| For the year ended December 31, 2023 | In millions |

| Select Financial Information | |

| Total Revenue | $ 173.2 |

| Total operating revenue* | $ 181.2 |

| Net loss attributable to Greenbacker | $ (79.5) |

| Adjusted EBITDA† | $ 31.8 |

| FFO† | $ (11.5) |

*Total operating revenue excludes non-cash contract amortization, net.

†See “Non-GAAP Financial Measures” for additional discussion. Adjusted EBITDA and FFO are unaudited.

Operating fleet adds 292 MW, including Company’s second and third largest operating projects to date

Much of the Company’s new investment activity in 2023 was directed toward the repowers and the continued development of its pre-operational assets. During the year, Greenbacker’s development and construction capabilities resulted in 292 MW of renewable energy assets being placed into service, growing its operating fleet by nearly 24%, year-over-year.

This additional capacity included the Company’s second and third largest operating assets to date. (The largest operational asset in the GREC portfolio is the 104 MWdc / 80 MWac Graphite solar project in Carbon County, Utah, which came online in 2022).

The two new projects were the 103.7 MWdc / 80 MWac MTSun solar project which entered operation in Yellowstone County, Montana during the first quarter of 2023, and the 99 MWdc / 80 MWac Fall River solar asset in Fall River, South Dakota which reached commercial operation in September 2023. Both assets have long-term PPAs in place with investment-grade utilities.

“After continuing to accelerate Greenbacker’s growth in 2023, we look forward to pushing the boundaries even further in 2024,” said Charles Wheeler, CEO of GREC. “We expect to start construction on our largest pre-operational asset to date, as well as begin the process of repowering additional assets in our operational fleet. Looking further ahead, we expect to complete construction on the vast majority of our pre-operational fleet and place it into service on a rolling basis by the end of 2027.”

Greenbacker’s 104 MW MTSun solar project

Majority of pre-operational fleet to enter operation, become revenue-generating by end of 2027

With the tailwinds of the IRA, and the expertise to harness them, Greenbacker plans to continue building out its pre-construction pipeline in 2024, converting development opportunities into risk mitigated pools of operational cash flows.

The Company expects that these additional operational assets will generate strong growth in revenues and EBITDA, as it begins benefiting from the additional contracted cash flows from an increasing number of operating projects.

The table below illustrates Greenbacker’s estimated timeline for bringing into service its current pre-operational pipeline.

| Operating Fleet (MW) | Pre-Operating Fleet (MW) | Total (MW) | |

| 4Q 2023 | 1,533 | 1,751 | 3,284 |

| 4Q 2024 | 1,788 | 1,496 | 3,284 |

| 4Q 2025 | 2,246 | 1,038 | 3,284 |

| 4Q 2026 | 3,103 | 181 | 3,284 |

| 4Q 2027 | 3,257 | 27 | 3,284 |

Compared with the estimated timeline included in Greenbacker’s third-quarter results press release, the table reflects approximately 64 MW that have been removed from Greenbacker’s fleet. The majority of these MW represent pre-operational assets that no longer optimally align with the Company’s investment strategy for various reasons, and their removal was de minimis to GREC’s overall value.

“In 2024, we plan to capitalize on our operational expertise and seek to deliver value to shareholders through yield compression on our assets,” said Dan De Boer, Greenbacker’s new Head of Infrastructure. “History shows that the best opportunities to invest have come out of periods of turbulence and uncertainty; with global infrastructure fundraising down significantly in 20236 and, in our view, a period of unprecedented macro expansion ahead of us in the energy transition space, we believe that the time to act on that opportunity is now.”

Company’s investments abate carbon emissions, conserve water, and support green jobs

Along with significant annual revenue and year-over-year production and capacity increases, GREC also continued to deliver on its sustainability and impact goals during the year.

As of December 31, 2023, Greenbacker’s clean energy assets had cumulatively produced approximately 8.7 million MWh of clean power since January 2016, abating over 6.1 million metric tons of carbon.7 The Company’s clean energy projects have saved more than 5.9 billion gallons of water,8 compared to the amount of water needed to produce the same amount of power by burning coal. Greenbacker’s investment activities will sustain over 6,400 green jobs.9

Additionally, Greenbacker officially became signatories of the internationally recognized Principles for Responsible Investment in 2023 and was also named to the prestigious ImpactAssets 50 2023 impact fund managers.

Greenbacker’s 99 MW Fall River solar project

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the federal securities laws. Forward-looking statements are not guarantees of future performance and involve known and unknown risks, uncertainties and other factors that may cause the actual results to differ materially from those anticipated at the time the forward-looking statements are made. Although Greenbacker believes the expectations reflected in such forward-looking statements are based upon reasonable assumptions, it can give no assurance that the expectations will be attained or that any deviation will not be material. Greenbacker undertakes no obligation to update any forward-looking statement contained herein to conform to actual results or changes in its expectations.

Non-GAAP Financial Measures

In addition to evaluating the Company’s performance on a U.S. GAAP basis, the Company now utilizes certain non-GAAP financial measures to analyze the operating performance of our segments as well as our consolidated business. Each of these measures should not be considered in isolation from or as superior to or as a substitute for other financial measures determined in accordance with U.S. GAAP, such as net income (loss) or operating income (loss). The Company uses these non-GAAP financial measures to supplement its U.S. GAAP results in order to provide a more complete understanding of the factors and trends affecting its operations.

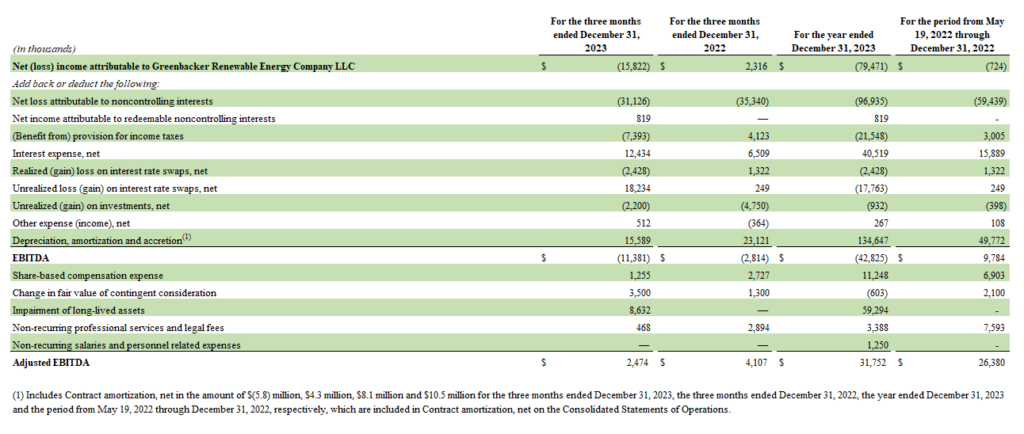

Adjusted EBITDA

Adjusted EBITDA is a non-GAAP financial measure that the Company uses as a performance measure, as well as for internal planning purposes. We believe that Adjusted EBITDA is useful to management and investors in providing a measure of core financial performance adjusted to allow for comparisons of results of operations across reporting periods on a consistent basis, as it includes adjustments relating to items that are not indicative on the ongoing operating performance of the business.

Adjusted EBITDA is a performance measure used by management that is not calculated in accordance with U.S. GAAP. Adjusted EBITDA should not be considered in isolation from or as superior to or as a substitute for net income (loss), operating income (loss) or any other measure of financial performance calculated in accordance with U.S. GAAP. Additionally, our calculation of Adjusted EBITDA may not be comparable to similarly titled measures reported by other companies.

Funds From Operations

FFO is a non-GAAP financial measure that the Company uses as a performance measure to analyze net earnings from operations without the effects of certain non-recurring items that are not indicative of the ongoing operating performance of the business. FFO is calculated using Adjusted EBITDA less the cash paid for interest expense (excluding the non-cash component) and distributions to tax equity investors under the financing facilities associated with our IPP segment.

The Company believes that the analysis and presentation of FFO will enhance our investor’s understanding of the ongoing performance of our operating business. The Company will continue to consider FFO, in addition to other GAAP and non-GAAP measures, in assessing operating performance and as a proxy for growth in distribution coverage over the long term.

FFO should not be considered in isolation from or as a superior to or as a substitute for net income (loss), operating income (loss) or any other measure of financial performance calculated in accordance with U.S. GAAP.

General Disclosure

This information has been prepared solely for informational purposes and is not an offer to buy or sell or a solicitation of an offer to buy or sell any security, or to participate in any trading or investment strategy. The information presented herein may involve Greenbacker’s views, estimates, assumptions, facts, and information from other sources that are believed to be accurate and reliable and are, as of the date this information is presented, subject to change without notice.

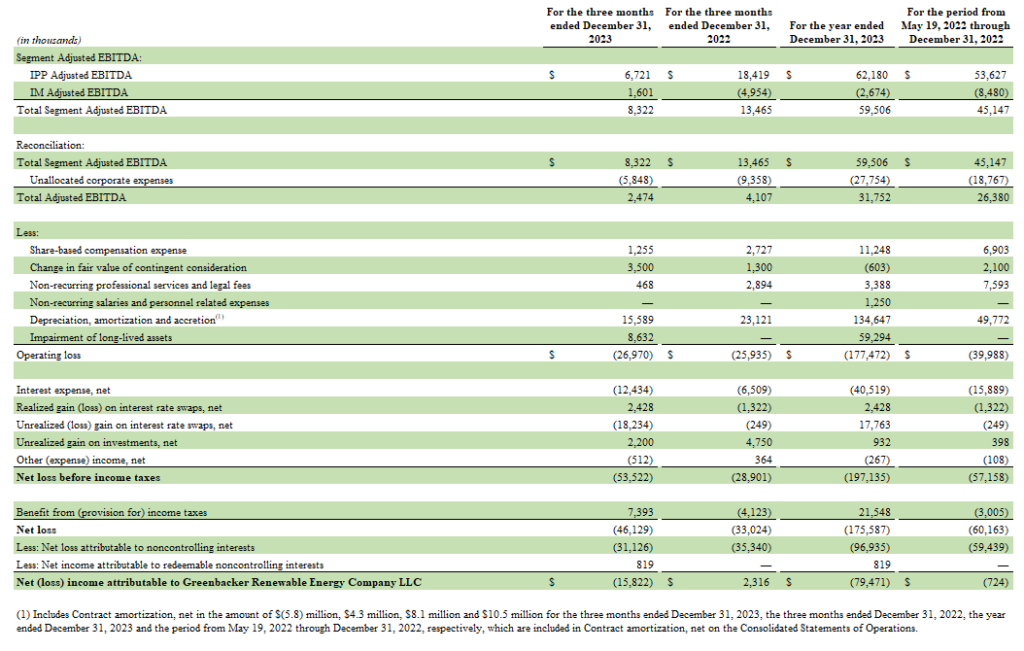

Non-GAAP Reconciliations

Adjusted EBITDA

The following table reconciles Net (loss) income attributable to Greenbacker Renewable Energy Company LLC to Adjusted EBITDA:

The Company defines Adjusted EBITDA as net income (loss) before: (i) interest expense; (ii) income taxes; (iii) depreciation expense; (iv) amortization expense (including contract amortization); (v) accretion; (vi) impairment of long-lived assets; (vii) amounts attributable to our redeemable and non-redeemable noncontrolling interests; (viii) unrealized gains and losses on financial instruments; (ix) other income (loss); and (x) foreign currency gain (loss). Additionally, the Company further adjusts for the following items described below:

- Share-based compensation is excluded from Adjusted EBITDA as it is different from other forms of compensation, as it is a non-cash expense and is highly variable. For example, a cash salary generally has a fixed and unvarying cash cost. In contrast, the expense associated with an equity-based award is generally unrelated to the amount of cash ultimately received by the employee, and the cost to the Company is based on a share-based compensation valuation methodology and underlying assumptions that may vary over time.

- The change in fair value of contingent consideration, which is related to Greenbacker’s acquisition of GCM and certain other affiliated companies, is excluded from Adjusted EBITDA, if any such change occurs during the period. The non-cash, mark-to-market adjustments are based on the expected achievement of revenue targets that are difficult to forecast and can be variable, making comparisons across historical and future quarters difficult to evaluate.

- Other costs that are not consistently occurring, not reflective of expected future operating expense, and provide no insight into the fundamentals of current or past operations of our business are excluded from Adjusted EBITDA. This includes costs such as professional services and legal fees, some of which were incurred as part of the transition to non-investment company accounting, and other non-recurring costs unrelated to the ongoing operations of the Company.

The Company uses Segment Adjusted EBITDA to evaluate the financial performance of and allocate resources among our operating segments. Segment Adjusted EBITDA is determined for our segments consistent with the adjustments noted above but further excludes unallocated corporate expenses as these items are centrally controlled and are not directly attributable to any reportable segment.

The following table reconciles total Segment Adjusted EBITDA to Net (loss) income attributable to Greenbacker Renewable Energy Company LLC:

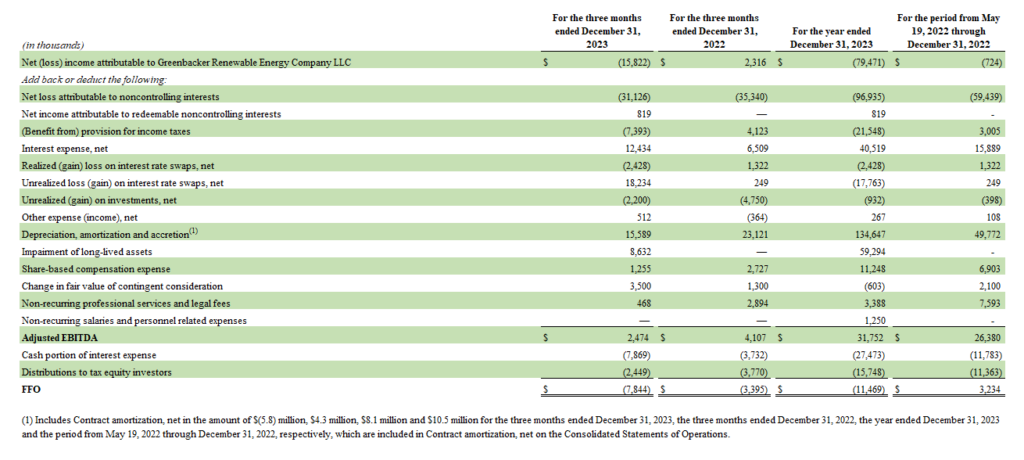

Funds From Operations

The following table reconciles Net (loss) income attributable to Greenbacker Renewable Energy Company LLC to Adjusted EBITDA and then to FFO:

FFO is a non-GAAP financial measure that the Company uses as a performance measure to analyze net earnings from operations without the effects of certain non-recurring items that are not indicative of the ongoing performance of the business.

FFO is calculated using Adjusted EBITDA less the impact of interest expense (excluding the non-cash component) and distributions to tax equity investors under the financing facilities associated with our IPP segment.

About Greenbacker Renewable Energy Company

Greenbacker Renewable Energy Company LLC is a publicly reporting, non-traded limited liability sustainable infrastructure company that both acquires and manages income-producing renewable energy and other energy-related businesses, including solar and wind farms, and provides investment management services to other renewable energy investment vehicles. We seek to acquire and operate high-quality projects that sell clean power under long-term contracts to high-creditworthy counterparties such as utilities, municipalities, and corporations. We are long-term owner-operators, who strive to be good stewards of the land and responsible members of the communities in which we operate. Greenbacker conducts its investment management business through its wholly owned subsidiary, Greenbacker Capital Management, LLC, an SEC-registered investment adviser. We believe our focus on power production and asset management creates value that we can then pass on to our shareholders—while facilitating the transition toward a clean energy future. For more information, please visit https://greenbackercapital.com.

1 Past performance is not indicative of future results.

2 Treasury and IRS Publish Long-Awaited Guidance on Renewable Energy Investment Tax Credit, Morgan Lewis, November 28, 2023.

3 The solar PTC is the game-changer that hasn’t been , Utility Dive, December 20, 2023.

4 Fee-earning AUM represents the asset base upon which management fee revenue is earned from GCM’s managed funds.

5 Aggregate AUM includes GREC and GCM’s managed funds. AUM represents the underlying fair value of investments, determined generally in accordance with ASC 820, cash and cash equivalents and project level debt. These figures are unaudited and subject to change.

6 Infrastructure fundraising slows down in 2023, Pensions & Investments, Larry Rothman, January 17, 2024.

7 When compared with a similar amount of power generation from fossil fuels. Carbon abatement is calculated using the EPA Greenhouse Gas Equivalencies Calculator which uses the Avoided Emissions and generation Tool (AVERT) US national weighted average CO2 marginal emission rate to convert reductions of kilowatt-hours into avoided units of carbon dioxide emissions.

8 Gallons of water saved are calculated based on Operational water consumption and withdrawal factors for electricity generating technologies: a review of existing literature – IOPscience, J Macknick et al 2012 Environ. Res. Lett. 7 045802.

9 Green jobs are calculated from the International Renewable Energy Agency‘s measurement that one megawatt of renewable power supports approximately four jobs. Data is as of December 31, 2023.